Atlante

News

Flash News Cocoa – Commodities Bulletin

26 July 2024

- African cocoa harvests continue to be on a downward trend, exacerbating the global deficit for the third consecutive marketing year, which is already suffering from a significant drop in production of more than 15% (-19% in Côte d’Ivoire and -27% in Ghana), keeping the market at extremely low stock levels. The ratio of stocks to consumption – an indicator of the level of market supply – has reached its lowest level since the 1970s.

- Bad weather, plantation diseases, and the limited use of fertilisers are the main factors reducing production. Due to the poor harvests, Ghana plans to postpone shipments of more than 350,000 tonnes of cocoa beans to next season.

- Stiff demand and rising costs are pushing cocoa prices to historic highs. At current price levels, the sales operations of the large chocolate producers on the stock exchange have become unsustainable and, in addition, uncertainty about the effects of the EU’s anti-deforestation regulations (which will come into force from 2025), container costs incurred due to geopolitical tensions on the Red Sea, and the smuggling of cocoa beans by Ghanaian farmers into neighbouring countries for higher profits are also putting further pressure on prices.

Cocoa bean prices consolidate unprecedented uptrend

Cocoa prices, which are rising due to supply and production issues in Ghana, once again reached USD 10,000 per tonne on 13 June. It is worth noting that prices are still 170% higher than in June 2023 and that since the beginning of 2024, the price of a tonne of cocoa has increased by approximately 135%.

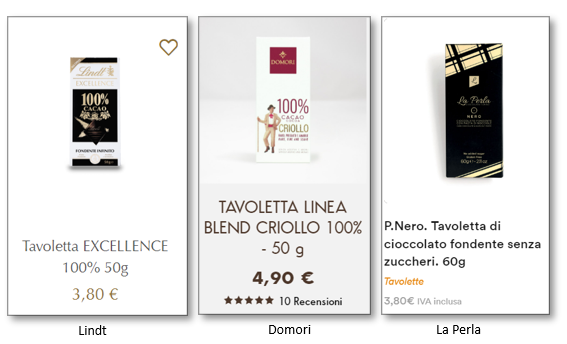

Shrinkflation in the world of chocolate

Shrinkflation is a commonly observed phenomenon in the chocolate industry. Chocolate bars, for example, have long been subject to shrinkflation, with manufacturers subtly reducing the weight or number of pieces in a bar without significantly changing the size of the package. This practice allows companies to maintain profitability in the face of rising production costs for ingredients such as cocoa and sugar, as well as higher packaging and transport costs. While shrinkflation may go unnoticed by some consumers, it often leads to frustration and a sense of diminishing value among loyal customers who realise they are getting less for their money.