Atlante

News

Skyrocketing cocoa prices are leading to chocolate scarcity

14 May 2024

Atlante, a company headquartered in Casalecchio di Reno, sounds the alarm on the surging cocoa prices, which are making chocolate progressively scarce on store shelves. Drought in key producing nations, aging plantations, and financial speculation stand as the primary culprits behind this crisis.

Atlante, a company headquartered in Casalecchio di Reno, sounds the alarm on the surging cocoa prices, which are making chocolate progressively scarce on store shelves. Drought in key producing nations, aging plantations, and financial speculation stand as the primary culprits behind this crisis.

Natasha Linhart, CEO of Atlante, explains the ramifications of this scenario in an interview with Corriere della Sera Bologna, providing insights and recommendations to tackle the shortage of raw material in the chocolate market.

“Skyrocketing cocoa prices are leading to chocolate scarcity”

The alert from Atlante, the Casalecchio-based company with a 15 million business in the industry

From Corriere della Sera Bologna – Alessandra Testa

14 May 2024

Atlante, headquartered in Casalecchio di Reno, operates in the retail sector as a trusted partner for major Italian and international chains, facilitating the sale of food specialties worldwide. Now, they are drawing attention to the alarming cocoa situation.

Atlante, headquartered in Casalecchio di Reno, operates in the retail sector as a trusted partner for major Italian and international chains, facilitating the sale of food specialties worldwide. Now, they are drawing attention to the alarming cocoa situation.

For weeks, even in the Bologna metropolitan area, shelves have been emptied, and chocolate tablets, particularly those of retailers’ own brands, are beginning to dwindle. Natasha Linhart, Atlante’s CEO, has signalled the scarcity of this prized raw material, which is driving prices to new heights and is already impacting cafés and small businesses, leaving them without deliveries.

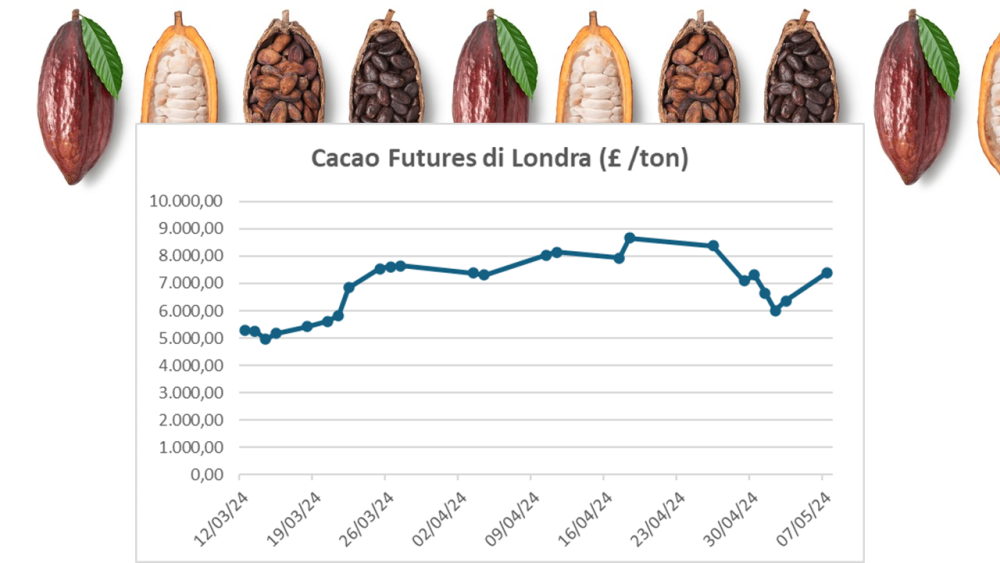

A business facing the risk of losing half its budget: for Atlante, chocolate represents an annual value of €15 million out of a total turnover of €270 million. “75% of the cocoa marketcomes from Ghana, Ivory Coast, and, to a lesser extent, Nigeria” explains the CEO.“Today, these countries, which have always faced political challenges, are grappling with an unprecedented drought that threatens traditional crops. Compounding this issue are aging plants, dwindling harvests, and financial speculation by major market players, leaving farmers discontented. Despite consumers’ ever-growing demand, cocoa prices have skyrocketed by 80%.”

“The continuous liquidity constraints on investors,” Linhart emphasizes, “have pushed cocoa futures prices downward, making the market even more vulnerable to sharp fluctuations in theoretical prices that do not necessarily reflect actual market prices. With many cocoa producers and chocolate manufacturing companies already procuring cocoa beans for the next season, they opt not to fulfil retail supply contracts.” Meanwhile, prospects for cocoa and cocoa butter prices remain bullish due to ongoing global supply uncertainties.

The result of this trend is already apparent in Italy, where 80,000 tons of chocolate are sold each year, generating sales of €450 million, and where consumers have sophisticated tastes and would never settle for substitutes instead of the nearly two kilograms per capita they indulge in annually. As is clear to the most observant citizens, “A chocolate bar that used to cost €1just a few months ago is now being sold for €4-5.”

The result of this trend is already apparent in Italy, where 80,000 tons of chocolate are sold each year, generating sales of €450 million, and where consumers have sophisticated tastes and would never settle for substitutes instead of the nearly two kilograms per capita they indulge in annually. As is clear to the most observant citizens, “A chocolate bar that used to cost €1just a few months ago is now being sold for €4-5.”

“Unfortunately, there is a tendency to view this crisis as temporary,” Linhart continues, “but that’ is not the case. The raw material deficit for 2024 already stands at 10%, roughly 500 thousand tons of cocoa in a global market that was 5 million tons in 2023, valued at 30 billion euros.”

“We can of course go without chocolate,” Linhart concludes, “but it is a significant source of pleasure for many of us. That’s why I urge the retail industry not to downplay this crisis, which is expected to last for at least two years. They should take pre-emptive actions akin to those of stock market operators: securing product bookings in advance and ensuring consistent availability on shelves. Despite potential price increases, consumers will still seek out that serotonin boost for their mood and will continue to make purchases.”